Tata Capital Share Price:

Track the latest Tata Capital share price on NSE and BSE. Get real-time updates, historical performance, financial overview, and expert insights on Tata Capital stock in December 2025 for informed investment decisions.

- Tata Capital Limited, the flagship financial services arm of the prestigious Tata Group, has been making waves in the Indian stock market since its highly anticipated listing in October 2025. As investors closely monitor the Tata Capital share price, the stock has shown resilience amid market fluctuations. This comprehensive guide dives deep into the current Tata Capital share price, its post-IPO performance, company fundamentals, and future outlook to help you make informed decisions.

Understanding Tata Capital Share Price Movements: The Tata Capital share price has been a topic of interest for both retail and institutional investors ever since the company debuted on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) on October 13, 2025. Listed under the symbol TATACAP, the stock opened at a modest premium to its IPO price band of ₹310-₹326 per share.

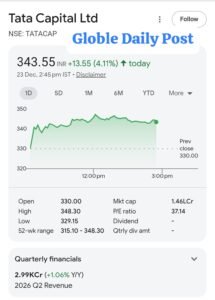

As of late December 2025, the Tata Capital share price hovers around the ₹340-₹345 range, with recent trading sessions showing prices between ₹330 and ₹344. The 52-week high stands at approximately ₹336.65-₹343.60, while the low is around ₹315.10. This range reflects steady trading post-listing, influenced by broader market sentiments in the NBFC sector.

Current Tata Capital Share Price Snapshot (December 2025)

- Latest Closing Price: Approximately ₹341-₹344 (subject to daily fluctuations)

- Market Capitalization: Over ₹140,000 crore

52-Week High/Low: ₹343.60 / ₹315.10

- P/E Ratio: Around 38x, indicating a premium valuation compared to some peers

- P/B Ratio: Approximately 3.2x

These figures highlight the stock’s stability, backed by the Tata brand’s reputation for trust and reliability.

Tata Capital IPO Recap: From Listing to Current Share Price:

Tata Capital’s IPO in October 2025 was one of the largest offerings of the year, raising over ₹15,500 crore through a combination of fresh issue and offer for sale (OFS). The IPO was priced at ₹326 per share, with subscription driven primarily by institutional investors.

The stock listed at around ₹330, a slight premium of about 1-2%. Post-listing, the Tata Capital share price experienced initial volatility but stabilized as the company demonstrated strong quarterly results. Key highlights from the IPO era:

- Subscription was fully covered, led by qualified institutional buyers (QIBs).

- The listing complied with RBI’s mandate for upper-layer NBFCs to go public.

- Promoter holding post-IPO adjusted, with Tata Sons retaining a significant stake.

Since listing, the Tata Capital share price has appreciated modestly, rewarding patient investors while reflecting the NBFC sector’s growth potential.

Factors Influencing Tata Capital Share Price Post-IPO:

Several elements have shaped the Tata Capital share price trajectory:

- Strong Financial Performance: Robust loan book growth and improved asset quality.

- Market Sentiment: Positive on diversified NBFCs amid economic recovery.

- Group Transfers: Recent intra-group share transfers (e.g., 0.10% to Tata Motors entities) under demerger schemes, effective from October 2025.

- Broader Economy: Interest rate cycles and credit demand impacting NBFC valuations.

Company Overview: Why Tata Capital Stands Out:

Tata Capital Limited is a subsidiary of Tata Sons Private Limited and operates as a core investment company (CIC) turned NBFC-Investment and Credit Company (ICC). Established in 2007, it has grown into one of India’s top diversified NBFCs, serving over 7.3 million customers as of mid-2025.

Key Business Segments:

Tata Capital operates across multiple verticals, making it a one-stop financial solutions provider:

- Consumer Loans: Personal loans, home loans, two-wheeler loans, and used car financing.

- Commercial Finance: Working capital, term loans, and structured products for SMEs and corporates.

- Wealth Services: Advisory, portfolio management, and private equity fund services.

- Other Offerings: Leasing, insurance distribution, credit cards (in partnership), and cleantech financing.

With a loan book exceeding ₹2.33 lakh crore as of June 2025, Tata Capital ranks among the fastest-growing NBFCs in India. Its omni-channel approach, combining digital platforms and physical branches, ensures wide accessibility.

Financial Highlights (FY 2025 and Recent Quarters):

- Revenue Growth: Significant YoY increase, driven by expanded lending.

- Profit After Tax (PAT): Strong figures, with quarterly PAT around ₹1,000-₹1,097 crore.

- Asset Under Management (AUM): Crossed ₹2.2 lakh crore mark.

- Asset Quality: Improving GNPA ratios, supported by prudent risk management.

These metrics underscore Tata Capital’s operational efficiency and position it favorably against peers like Bajaj Finance or Mahindra Finance.

Tata Capital Share Price Performance Analysis Historical Trends

Since its October 2025 listing:

- Initial months saw consolidation around ₹320-₹330.

- By December 2025, the Tata Capital share price climbed to highs near ₹344, reflecting positive investor sentiment.

- Monthly returns have been stable, with minor dips attributed to sector-wide corrections.

Peer Comparison

Compared to other NBFCs:

- Tata Capital’s valuation (P/E ~38x) is reasonable given its growth rate and brand strength.

- Lower volatility than smaller NBFCs, thanks to Tata Group’s backing.

Technical Outlook for Tata Capital Share Price:

- Support Levels: ₹315-₹320

- Resistance Levels: ₹345-₹350

- Moving Averages: Bullish crossover in recent sessions suggests potential upside.

Analysts recommend monitoring quarterly results for sustained momentum in the Tata Capital share price.

Investment Potential: Is Tata Capital Share Price a Good Buy?

The Tata Capital share price offers attractive long-term potential due to:

- Brand Legacy: Tata Group’s 150+ years of trust enhances customer loyalty.

- Diversification: Balanced portfolio across retail, SME, and corporate lending reduces risks.

- Growth Drivers: Rising credit demand in India, digital innovation, and cleantech initiatives.

- Sustainability Focus: Investments in green financing align with global trends.

However, risks include interest rate hikes, competition from fintechs, and economic slowdowns impacting loan repayments.

Expert Views on Tata Capital Share Price

Many brokerages maintain a “Buy” or “Outperform” rating, citing undervaluation relative to growth prospects. Target prices often range higher than current levels, implying upside potential.

Future Outlook for Tata Capital Share Price

Looking ahead, the Tata Capital share price is poised for growth supported by:

- Expansion in rural and affordable housing finance.

- Digital transformation enhancing customer acquisition.

- Potential synergies within the Tata ecosystem.

As India’s financial sector evolves, Tata Capital remains a strong contender for portfolio diversification.

In conclusion, the Tata Capital share price reflects a blend of stability and growth potential. For the latest updates, always check NSE/BSE platforms or reliable financial portals. Investing in stocks involves risks; consult a financial advisor before making decisions.

Author Profile

- Global Daily Post – Your Trusted Source for Global News & Updates

Globle Daily Post is a leading news platform that covers cricket news, automotive launches, gold silver rates, and international news in real-time.

Latest entries

IndiaFebruary 9, 2026Sensex Jumps 415 Points in Early Trade, Nifty Rises 126 Points on Strong Global Cues

IndiaFebruary 9, 2026Sensex Jumps 415 Points in Early Trade, Nifty Rises 126 Points on Strong Global Cues IndiaFebruary 9, 2026Mohammed Shami Smashes 30-Ball Fifty With 7 Fours and 3 Sixes, Stuns Fans

IndiaFebruary 9, 2026Mohammed Shami Smashes 30-Ball Fifty With 7 Fours and 3 Sixes, Stuns Fans WorldFebruary 6, 2026Ukraine War Briefing: Kyiv and Moscow Conduct Major Prisoner Exchange

WorldFebruary 6, 2026Ukraine War Briefing: Kyiv and Moscow Conduct Major Prisoner Exchange WorldFebruary 6, 2026Epstein Files Exposed: Dark Truths, Shocking Evidence, and the Uncomfortable Reality Behind the Scandal

WorldFebruary 6, 2026Epstein Files Exposed: Dark Truths, Shocking Evidence, and the Uncomfortable Reality Behind the Scandal