Tata Technologies Share Price Target 2026–2030: Can This Tata Group Stock Become a Long-Term Wealth Creator

Tata Technologies Ltd has steadily gained attention among long-term investors looking beyond traditional IT services stocks. As a core engineering and digital transformation company under the Tata Group umbrella, Tata Technologies operates at the heart of industries shaping the future — electric vehicles, smart manufacturing, aerospace, and industrial automation.

Since its listing, the stock has seen sharp ups and downs, driven by valuation concerns, earnings performance, and global economic sentiment. However, as markets mature and investors increasingly focus on multi-year growth stories, the spotlight has shifted toward the Tata Technologies share price target from 2026 to 2030.

So, what do experts expect over the next five years? Let’s break it down.

- Tata Technologies Share Price Target 2026–2030: Can This Tata Group Stock Become a Long-Term Wealth Creator

Understanding Tata Technologies’ Business Model

Unlike conventional IT services firms that focus mainly on software outsourcing, Tata Technologies specializes in engineering-led digital services. The company helps global manufacturers design, develop, and improve complex products using advanced engineering tools, simulation software, and digital platforms.

Its strongest presence is in:

- Automotive and electric vehicles

- Aerospace and defense

- Industrial machinery and heavy engineering

This niche positioning makes Tata Technologies a long-term play on global manufacturing transformation rather than short-term IT spending cycles.

Current Market Sentiment

Analyst sentiment around Tata Technologies remains mixed but improving. While some brokerages remain cautious due to premium valuation and margin pressures, others see strong long-term potential driven by rising global demand for engineering services.

The stock’s wide analyst price band reflects this divergence — indicating both opportunity and risk for investors.

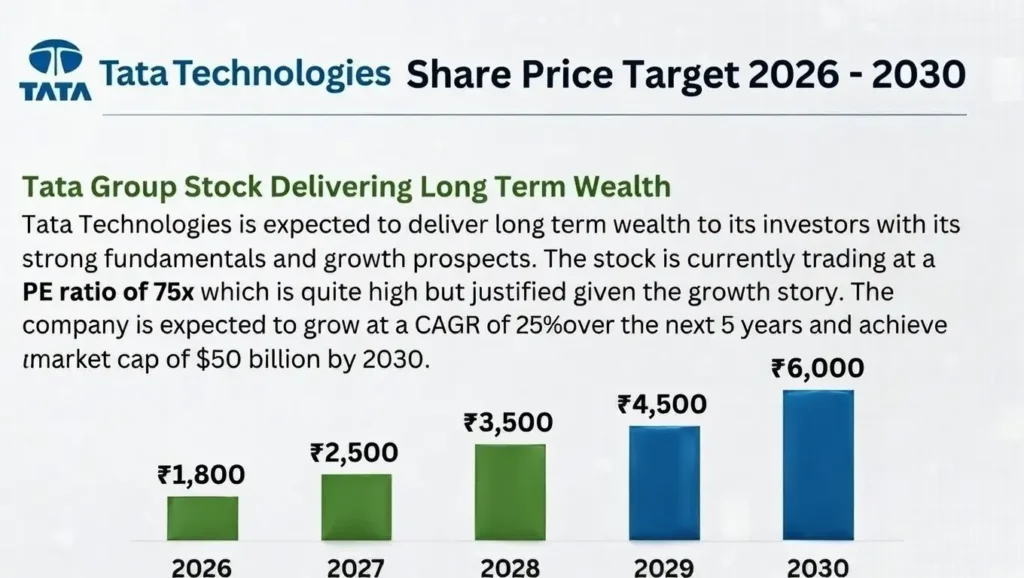

Tata Technologies Share Price Target 2026–2030

Based on expert estimates, long-term forecasts, and sector trends, Tata Technologies is expected to show gradual but consistent growth over the next five years, provided execution remains steady.

Year-Wise Share Price Target (₹)

| Year | Expected Target Range |

|---|---|

| 2026 | ₹670 – ₹680 |

| 2027 | ₹710 – ₹740 |

| 2028 | ₹760 – ₹790 |

| 2029 | ₹810 – ₹850 |

| 2030 | ₹870 – ₹900 |

These projections assume moderate revenue growth, stable margins, and continued demand from global manufacturing clients.

Key Growth Drivers Behind the Forecast

1. Electric Vehicle Revolution

Global automakers are rapidly shifting toward electric and hybrid vehicles. Tata Technologies plays a critical role in vehicle design, battery engineering, and digital simulation — making it a direct beneficiary of this structural shift.

2. Rise of Smart Manufacturing

Industries worldwide are adopting smart factories, digital twins, and automation. Engineering services companies like Tata Technologies are central to this transition.

3. Long-Term Client Contracts

Engineering engagements are typically long-term and deeply integrated into client operations, providing predictable revenue and higher switching costs.

4. Tata Group Advantage

Being part of the Tata ecosystem enhances credibility, client trust, and access to large global contracts.

Why Some Experts Remain Cautious

Despite strong long-term fundamentals, experts highlight several risks:

- Premium valuation: The stock trades at higher multiples than many peers

- Margin pressure: Rising costs and competitive pricing can impact profitability

- Cyclical exposure: Automotive and industrial sectors are sensitive to global slowdowns

- Earnings volatility: Quarterly performance may remain uneven

These factors can lead to short-term corrections, even within a long-term growth story.

Is Tata Technologies Suitable for Long-Term Investors?

From a long-term perspective, Tata Technologies offers exposure to future-oriented themes rather than legacy IT outsourcing. Experts suggest that investors with patience and a higher risk appetite may find value in holding the stock over a multi-year horizon.

However, the stock may not suit investors seeking quick returns or low volatility.

What Should Investors Watch Going Forward?

Key factors to track include:

- Quarterly revenue growth

- Operating margin trends

- Large deal wins and client additions

- Exposure diversification beyond automotive

Consistent improvement in these areas could support higher valuations over time.

Final Verdict

The Tata Technologies share price target from 2026 to 2030 reflects cautious optimism. While the stock may experience volatility in the short term, its positioning in engineering, EVs, and digital manufacturing places it well for long-term value creation.

For disciplined investors willing to ride out market cycles, Tata Technologies could gradually evolve into a meaningful long-term wealth creator.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. Please consult a certified financial advisor before making any investment decisions.

Union Budget 2026: Income Tax Relief, High-Speed Trains & Common Man Wins

Silver Rate Today: Why Silver Prices Slipped Below ₹4 Lakh per Kg After Record Rally

Author Profile

- Global Daily Post – Your Trusted Source for Global News & Updates

Globle Daily Post is a leading news platform that covers cricket news, automotive launches, gold silver rates, and international news in real-time.

Latest entries

IndiaFebruary 9, 2026Sensex Jumps 415 Points in Early Trade, Nifty Rises 126 Points on Strong Global Cues

IndiaFebruary 9, 2026Sensex Jumps 415 Points in Early Trade, Nifty Rises 126 Points on Strong Global Cues IndiaFebruary 9, 2026Mohammed Shami Smashes 30-Ball Fifty With 7 Fours and 3 Sixes, Stuns Fans

IndiaFebruary 9, 2026Mohammed Shami Smashes 30-Ball Fifty With 7 Fours and 3 Sixes, Stuns Fans WorldFebruary 6, 2026Ukraine War Briefing: Kyiv and Moscow Conduct Major Prisoner Exchange

WorldFebruary 6, 2026Ukraine War Briefing: Kyiv and Moscow Conduct Major Prisoner Exchange WorldFebruary 6, 2026Epstein Files Exposed: Dark Truths, Shocking Evidence, and the Uncomfortable Reality Behind the Scandal

WorldFebruary 6, 2026Epstein Files Exposed: Dark Truths, Shocking Evidence, and the Uncomfortable Reality Behind the Scandal